A closer look at the Pay Stub Canva Template

Tracking payments doesn’t have to be stressful; this fillable Pay Stub Template keeps all payroll information in one professional, easy-to-manage document.

Created with real payroll needs in mind, this template was inspired by best practices from Mojo Generator and designed to save you time while maintaining accuracy. In 2025 alone, nearly 300 copies were sold, helping freelancers and small businesses stay organized.

What’s included:

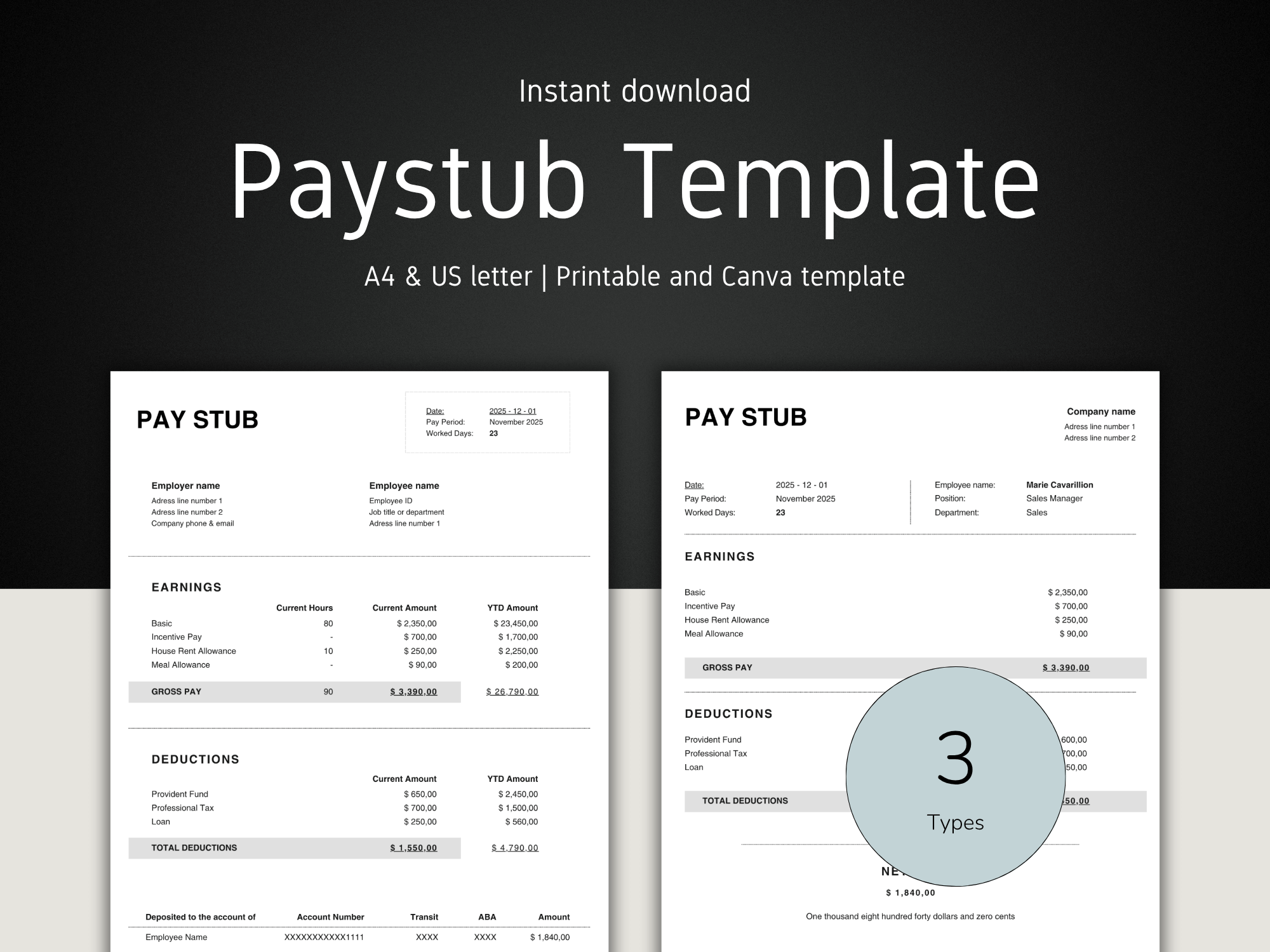

3 Fillable Pay Stub designs to choose from, each offering a slightly different layout to suit your needs:

- Version 1: Standard pay stub layout with detailed earnings, deductions, gross pay, and net pay sections;

- Version 2: Includes signature fields for both employer and employee with sligthly bigger fonts;.

- Version 3: A layout with where sections for department are highlighted.

Sample text provided: Each stub comes with example entries to guide you in filling your own details.

This template keeps everything organized and professional:

- General information: Employer and employee names, addresses, pay period, and employee ID;

- Pay rates & hours: Shows current hours worked, pay rates, and calculations for gross pay;

- Deductions & contributions: Federal, state, local taxes, Social Security, Medicare, retirement plans, or other benefits;

- Year-to-date totals: Tracks cumulative earnings and deductions;

- Net pay: Clearly shows the final payment amount, including optional text spelling out the total;

- Paid time off: Optionally record accrued vacation, sick, or personal hours.

Each version of the template presents the information differently, so you can pick the layout that best fits your workflow or client needs.

With this template, you can:

- Record payments accurately for yourself or employees;

- Maintain professional records for clients, staff, or audits;

- Save time and reduce payroll mistakes.

Who it’s for:

Freelancers, small business owners, and service providers who want a professional and reusable pay stub. Perfect for weekly, bi-weekly, monthly, or project-based payments.

Any debt problems? Check out our Debt Payoff Planner

- Instant download: Start using your payroll template right after purchase;

- PDF and Canva compatibility;

- 3 ready-to-use designs;

- Pre-made structure to manage payroll clearly.

Covers all essentials

Track everything you need: earnings, deductions, taxes, net pay, gross pay, year-to-date totals, and more. Each template is designed to include all the key information required for accurate and professional pay stubs.

No complicated software or accounting experience required. The template is fillable and fully editable in Canva or PDF format. Just enter your data and print or share.

Perfect for anyone

This template works for all skill levels. No prior payroll knowledge is necessary, just plug in the numbers and get results.

It's a low-cost, long-term solution

A one-time purchase gives you a flexible tool you can use week after week, month after month. Simply replace the data for each pay period. No need to buy new templates each time.

Three clean, pre-designed layouts give you options for different workflows, from simple employee tracking to detailed, signature-ready pay stubs.

Who this template is for

This product is perfect for anyone looking to simplify payroll management:

✔️ Freelancers managing client payments;

✔️ Small business owners handling payroll;

✔️ Service providers tracking hours, deductions, and net pay.

Here are the sections you can fill in in the Pay Stub, these are example data that you can change according to your needs, simply by editing the file in Canva:

- Header section; Title 1099 PAY STUB

Date 2025-12-01

Pay period: November 2025, worked days: 23

- Employer& Employee information

Employer name with adress and company contact info

Employee name with Employee ID, Job title/Department and adress

- Earnings Section

Columns: Current hours, current amount, YTD amount

Items listed: Basic, incentive pay, house rent, allowante, meal allowance

GROS Pay for 1099 Pay Stub

- Deduction section

Columns: Current amount, YTD amount

Items listed: Provident fund, professional TAX, load

Total deduction

- NET Pay for 1099 Pay Stub

- Deposited to the account of Employee name

Account number, transit, ABBA and amount deposited